Georgia payroll calculator 2023

Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t. Free Unbiased Reviews Top Picks.

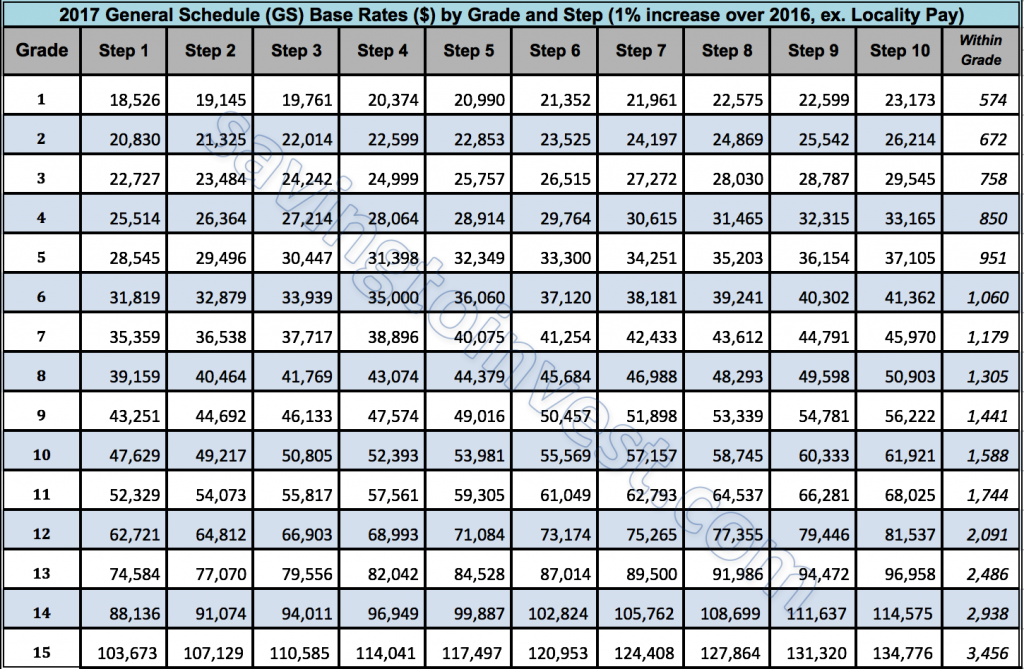

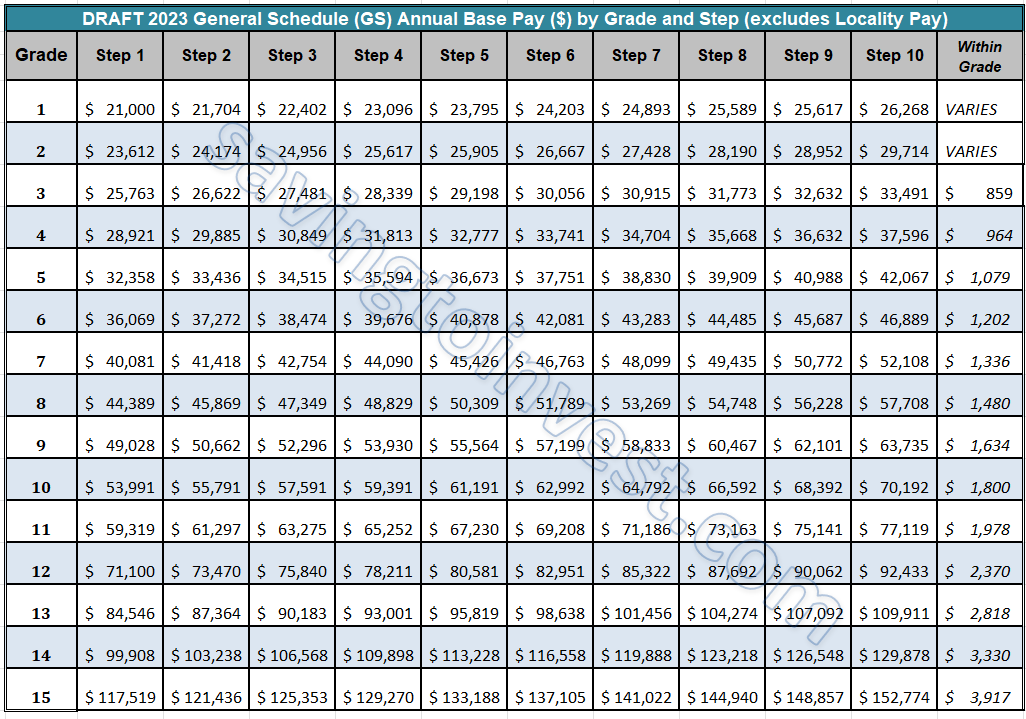

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Features That Benefit Every Business.

. Ad Compare This Years Top 5 Free Payroll Software. Based Specialists Who Know You Your Business by Name. Just enter the wages tax withholdings and other information required.

Secondly FICA and state. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Temporary Salary Supplement 195 KB Microsoft Word Document 85 KB.

Features That Benefit Every Business. Based Specialists Who Know You Your Business by Name. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Georgia tax year runs from July 01 the year before to June 30 the current year. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Discover ADP Payroll Benefits Insurance Time Talent HR More.

2023 Lincoln Avi Kamis 08 September 2022 Edit. Ad Payroll Made Easy. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Georgia Paycheck Calculator 2022 - 2023. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

Iowa also requires you to pay. To begin with federal income is taxed at 1227 percent while state income is taxed at 462 percent. Ad Payroll Made Easy.

Ad Process Payroll Faster Easier With ADP Payroll. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Get Started With ADP Payroll. In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. Free Georgia Payroll Tax Calculator and GA Tax Rates.

Georgia payroll calculator 2023. Get Started With ADP Payroll. All Services Backed by Tax Guarantee.

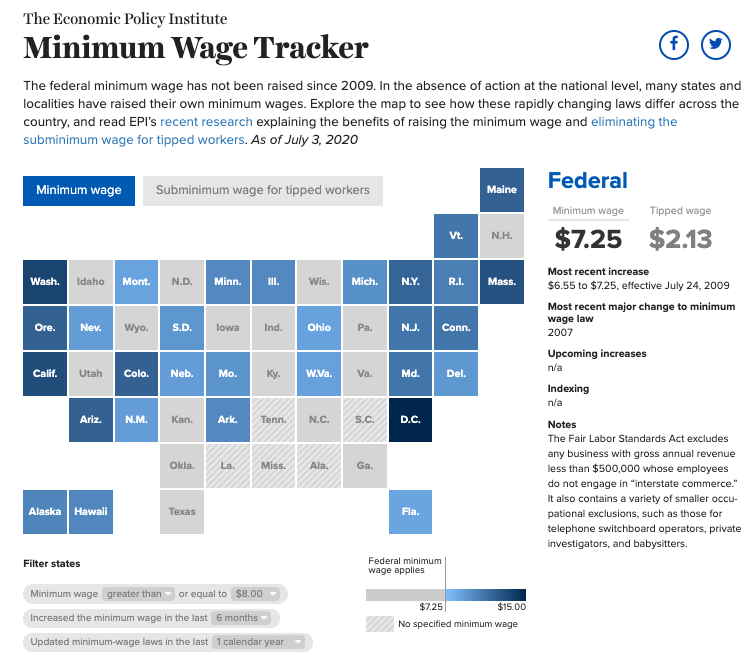

Employers also have to pay a matching 62 tax up to the wage limit. Once students are eligible to take major-level Computer Science courses CSC 2720 and 3000- and 4000-level. For 2022 the minimum wage in Georgia is 725 per hour.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Free Unbiased Reviews Top Picks. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Georgia Salary Paycheck Calculator. Lets go through your gross salary in further depth.

Georgia payroll calculator 2023 Tuesday September 6 2022 Edit. Free Unbiased Reviews Top Picks. Calculating your Georgia state.

Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to. Fy 2022 state salary schedule folder name. Get Started With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software.

Georgia Payroll Tax Rates.

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

2022 2023 Latest Chinese Baby Gender Prediction Calendar Boy Or Girl Youtube In 2022 Baby Gender Prediction Gender Prediction Gender Prediction Calendar

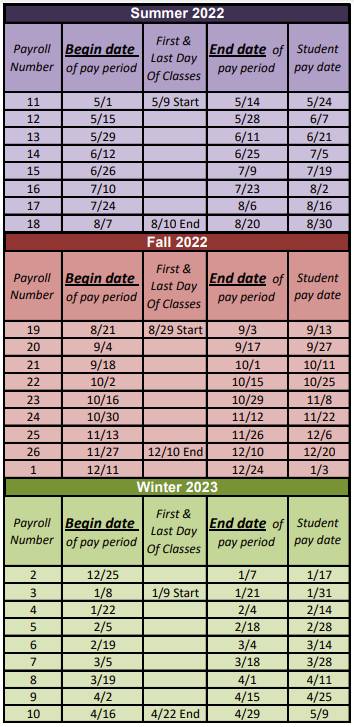

Pay Periods And Pay Dates Student Employment Grand Valley State University

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Eligibility Income Guidelines Georgia Department Of Public Health

Calculator And Estimator For 2023 Returns W 4 During 2022

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

Substitute Services Pay And Payroll

General Schedule Gs Base Pay Scale For 2022

Lawmakers Push For 5 1 2023 Federal Pay Raise Fedsmith Com

Minimum Wage Tracker Economic Policy Institute

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements